For now, the answer is no. Overall, the housing market this spring is hot, way hotter than any normal spring. For the most part, this is just the natural result of supply that is at record lows thanks to the price declines of the last few years.

| The Great Bubble | Spring 2013 |

|---|---|

| High price to income (PI) ratios | Low to average PI ratios |

| Lots of new listings | Record low new listings |

| Record high sales volume | Average sales volume |

| Extremely easy credit | Relatively tight credit |

A Mini Bubble Brewing in a Few Cities

The market today is so hot that many Redfin Agents are concerned that we’re entering into bubble territory. At a recent lunch with a half-dozen Redfin Agents, Redfin CEO Glenn Kelman asked whether they felt that the market was getting bubbly. They all nodded vigorously.

In some markets, there may be a “Mini Bubble” going on right now. This map shows the four markets most likely to be in a Mini Bubble, and the four least likely:

| Market | Price to Income vs. Jan-00 | Sale to List Mar-13 | Flips* Mar-13 | Multiple Offers Mar-13 | 2-Week Pending Mar-13 |

|---|---|---|---|---|---|

| Washington DC | 26% | 98% | 11% | 71% | 43% |

| Los Angeles | 26% | 100% | 10% | 91% | 52% |

| San Diego | 13% | 99% | 11% | 91% | 50% |

| San Francisco | 12% | 104% | 10% | 93% | 60% |

| New York | 9% | 94% | 6% | 68% | 9% |

| Portland | 8% | 99% | 8% | 60% | 41% |

| Boston | 6% | 97% | 11% | 74% | 3% |

| Seattle | 4% | 100% | 12% | 74% | 48% |

| Denver | 0% | 100% | 12% | 46% | 52% |

| Phoenix | -4% | 99% | 10% | 36% | 37% |

| Charlotte | -8% | 97% | 3% | 50% | - |

| Dallas | -10% | 98% | 7% | 46% | 28% |

| Las Vegas | -14% | 101% | 10% | - | 14% |

| Chicago | -17% | 97% | 7% | 51% | 12% |

| Atlanta | -20% | 99% | 18% | 50% | 24% |

| National | 5% | 99% | 10% | 76% | 35% |

* “Flips” refers to the percentage of home sales where the same home also sold at least once more in the preceding 18 months.

What makes a Bubble?

Multiple offers are becoming the norm in many markets. More than a third of new listings are pending within a week, over half in much of California. Inventory hits a new record low every month. There’s no doubt that this market feels similar in many ways to the bubble of 2005 and 2006, but a real estate bubble is more than stiff competition among buyers and rapidly rising prices.

Consider some of the features of the real estate bubble that dramatically burst in 2008, taking the entire economy with it. The Great Housing Bubble had the following characteristics…

Rapidly Rising Home Prices

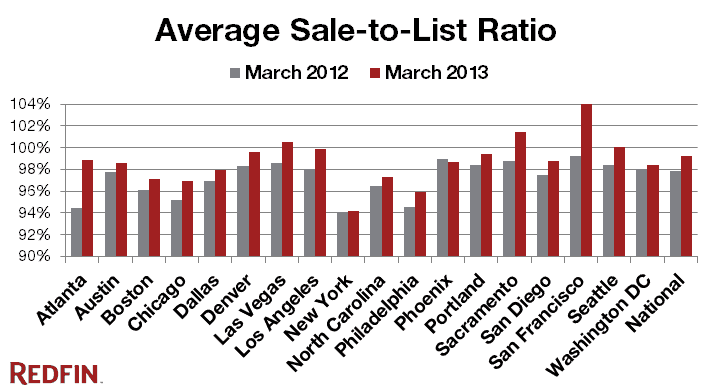

All 20 markets tracked by the Case-Shiller home price index experienced year-over-year price gains from 2003 all the way through early 2006. Now, home prices are definitely rising rapidly in many markets. Of the 19 markets we track as part of the Redfin Real-Time Home Price Tracker, 12 saw double-digit price gains between March 2012 and March 2013. Sale-to-list ratios are 98% or higher in over two thirds of Redfin’s markets and up from a year ago in every market but Phoenix:

But a spike in home prices alone does not a bubble make. Over the long term home prices have historically risen slightly faster than the rate of inflation. The recent spike in prices is just a return to the long-term trend in many markets that overcorrected, which leads us to…

Home Prices Detached From Incomes

One of the easiest ways to tell if you’re in a housing bubble is to compare home prices to incomes. If home prices are rising considerably faster than incomes, chances are good that there’s a bubble. Over the long term, price to income ratios should remain relatively stable in any given market, barring dramatic improvements or collapses in the local economy.

To investigate where this metric sits today, we compared the Case-Shiller home price index to per capita incomes from the U.S. Bureau of Economic Analysis. Between January 2000 and the height of the housing bubble between 2005 and 2006, the price to income ratio rose over 50 percent in half of the twenty metro areas tracked by Case-Shiller. Across the nation as a whole, home prices rose 102% between January 2000 and December 2005, while incomes rose just 24%.

Today, in 11 of the 20 markets, price to income ratios are at or below where they were in 2000. Just four markets are in possible “bubble” territory, 10% or more above their January 2000 level: Washington DC (+26%), Los Angeles (+26%), San Diego (+13%), and San Francisco (+12%).

Change in home price to per-capita income ratio since Jan. 2000

| Case-Shiller Metro Area | Peak | Latest |

|---|---|---|

| Atlanta | 12% | (20%) |

| Boston | 51% | 6% |

| Charlotte | 23% | (8%) |

| Chicago | 34% | (17%) |

| Cleveland | 8% | (26%) |

| Dallas | 10% | (10%) |

| Denver | 16% | 0% |

| Detroit | 11% | (35%) |

| Las Vegas | 83% | (14%) |

| Los Angeles | 103% | 26% |

| Miami | 106% | 10% |

| Minneapolis | 42% | (7%) |

| New York | 69% | 9% |

| Phoenix | 72% | (4%) |

| Portland | 49% | 8% |

| San Diego | 93% | 13% |

| San Francisco | 79% | 12% |

| Seattle | 45% | 4% |

| Tampa | 86% | (3%) |

| Washington DC | 92% | 26% |

| Composite-20 | 63% | 5% |

Lots of Listings and Sales

When home prices were shooting to new highs in 2005, sales and listings were off the charts. Inventory was low, but not for lack of new listings. Plenty of new homes were coming on the market daily—new and existing home sales hit levels in 2005 that were more than double their early 1990s levels—but record sales were keeping standing inventory low.

Contrast that with today’s market, where new listings are scarce and standing inventory is at record lows. Sales are up quite a bit from their post-bubble lows, but current levels are roughly on par with pre-bubble averages. To put it another way, during the frenzy in 2005, inventory felt tight because many buyers were acting crazy, but today inventory is actually tight. Tight inventory naturally leads to price increases.

Proliferation of Sketchy Financing

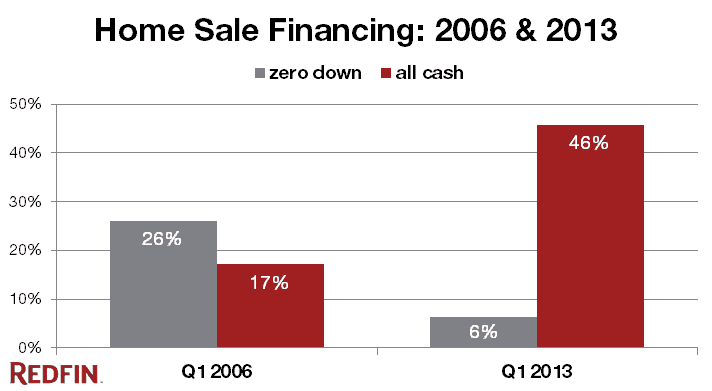

At the height of the market frenzy in 2006, abundant financing was available to anyone who could fog a mirror. No job, no income, no assets? No problem! Over a quarter of homes were purchased with zero-down loans. Many of those homes ended up as the foreclosures and short sales that caused much of the post-bubble pain the housing market has experienced the last few years. Meanwhile, all-cash deals were relatively rare, making up about 17% of sales.

Today the tables are completely turned. Just six percent of sales are backed by zero-down loans, while nearly half of sales (46%) are all-cash. Much of the frenzy we’re experiencing today is driven by investors. That doesn’t necessarily mean that prices are reasonable, but it does mean that we won’t be seeing the same kind of crash we had in 2008.

So What Will the Next Bust Look Like?

In our most recent buyer survey 58% of buyers—62% in Washington DC and Los Angeles—indicated “low interest rates” as one of the primary reasons they’re buying now. The Mortgage Bankers Association forecasts that the interest rate on a 30-year fixed-rate mortgage—currently at 3.57%—will rise nearly a full point to 4.5% by this time next year. That’s still low by historic standards but could easily be enough to significantly dampen buyer enthusiasm.

At the same time, the recent upticks in prices will bring more sellers into the market over the next year, and homebuilders are still ramping back up, with new home sales likely to increase quite a bit from their current level.

In other words, over the next year inventory will increase and demand will decrease. In markets where home prices are at or below a level supported by local incomes, this will just slow down appreciation, but in Washington DC and Los Angeles this could trigger a minor correction, knocking around five percent off home prices in those markets.

In Washington DC, where the home price to income ratio is 26% above the January 2000 level, Redfin Agent Philip Gvinter recently wrote an offer with no appraisal contingency, no inspection contingency, accepting the home in as-is condition, a 14 day financing contingency, and a $40,000 escalation clause, but still came in second out of thirteen offers. “We are definitely in the beginning phases of a bubble,” remarked Gvinter.

San Diego is also a risk, but to a much lesser degree, since prices there haven’t shot up as much yet. In San Francisco, well over a third of the sales are all-cash, but the home price to income ratio is 12% above the January 2000 level, and rising. Redfin Agent Charmaine Frank describes the market there as “a complete frenzy,” and observes that “some properties are receiving upward of 40 to 60 offers and selling in 24 hours or less.” This in a market where the median home price in March was over $800,000. However, since income data does not include capital gains such as stock sales, which are a big driving force in the Bay Area right now, it’s unlikely that there will be a correction there unless tech stocks crash first.

What’s a Buyer or Seller to Do?

If you’re buying a home in Washington DC or Los Angeles right now, be cautious. If you find a home that you can’t live without and you can get it for a price that you are 100% comfortable with, go for it, but it’s not worth over-extending or compromising in this market when lower prices, higher selection, and less competition may be just around the corner.

If you’re buying in the middling markets, there’s no need to be concerned about near-term price declines, but it also won’t hurt to wait it out for a year or so for the frenzy to die down. Prices aren’t likely to be much higher. If you’re a price-sensitive buyer in Atlanta, Chicago, Las Vegas, or Dallas, buying soon would be a good idea, since prices are likely to go up before they stabilize at historically supported levels.

If you’re thinking of selling your home to sell in Washington DC or Los Angeles, you would do well to get it on the market now. Take full advantage of the current frenzy, rent a while, then look to buy in a year or so when inventory will probably be higher. If you play your cards right you’ll get a nice down payment out of your current home, so higher rates won’t affect you as much when you buy later.

Don’t Call it a Comeback (of the Bubble)

The dearth of listings and price gains we’re seeing in today’s market are not sustainable, but the evidence points to more of a “bottom bounce” than a bubble. Things will settle down, the imbalance between buyers and sellers will inevitably tilt back to equilibrium, but barring a massive external economic disruption or major world war, prices are unlikely to drop considerably from where they are today.